Extending the lease of a flat

Extending your lease adds value to your property

Why extend? Because it protects the value of, and adds value to, your property. Having a longer lease will make it easier for a purchaser to obtain a mortgage, and therefore your flat will be more attractive relative to others with shorter leases: this is the main reason a longer lease adds value to your flat.

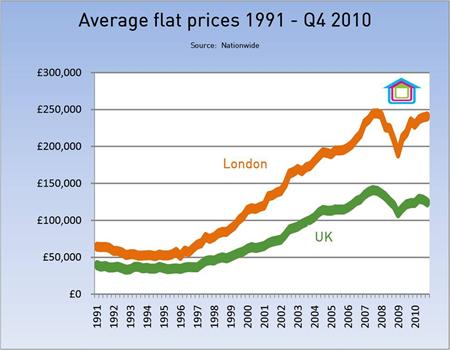

The cost of extending your lease will increase as prices rise and as your lease length declines over time.

Extend Now will provide valuation advice which you can use to negotiate the premium

Extend Now provides the initial professional valuation advice which you need to 'get the ball rolling'. This is provided in the format of an initial report.

The valuation advice covers a variety of scenarios and you can use this to negotiate the premium. If required, we can also negotiate the transaction with the landlord or the landlord's surveyor and if necessary represent you at a tribunal. Unless the landlord is being unreasonable, it is usually possible to negotiate a fair premium with the landlord thus avoiding the costs of a tribunal.

Your landlord has to give you a 90 year extension

The law grants you the right to extend your lease by 90 years e.g. if there are presently 76 years remaining, you can obtain an extension to 166 years. This applies whether or not the landlord agrees.

The law does not prohibit you from agreeing other sorts of lease extensions privately with your landlord - it is just that the only sort of lease extension the law forces your landlord to agree to is the 90 year one.

When you extend your lease by the 90 year route, the ground rent is ‘bought down’ to zero e.g. if previously your ground rent is £100 yearly, the new ground rent will be zero. This comes into effect immediately, not after the expiry of the original term.

Extend your lease before the unexpired term reaches 80 years

Where possible you should extend your lease before the number of years remaining reduces to below 80. For reasons to do with ‘marriage value’, it gets significantly more expensive to extend your lease when the unexpired term falls below 80 years.

You can still extend your lease if the unexpired term falls below 80 years - it will just cost more.

The legal requirements

You have to be a ‘qualifying leaseholder’. This basically means:

(i) You have to have owned the flat for a minimum period of 2 years; and

(ii) The original lease was granted for a term of at least 21 years - generally leases are granted for at least 99 years so this is almost never an issue.

Options open to you if you're buying a flat with a short lease

(i) get the existing owner to extend the lease before you complete the purchase i.e. the exchange of contracts would be conditional on that happening;

(ii) get the existing owner to serve a statutory notice requiring the freeholder to extend the lease by 90 years and arrange for the benefit of the notice to be assigned to you so you can take over the process – it is best to use a solicitor who is familiar with this process;

(iii) buy the flat with the short lease then attempt to negotiate a non-statutory lease extension with the freeholder (i.e. the two parties reach agreement - here "non-statutory" means the freeholder cannot be compelled to grant the extension), or wait for two years (the minimum period) then serve a statutory notice on the freeholder.

If the existing lease is approaching the 80 year point it is best to get the current owner to serve a notice and to get the benefit of this transferred to you when the purchase completes.

If you are considering doing this and require valuation advice, just run through the application form and answer "yes" to the question "Have you owned the property for at least 2 years?".

Procedure and timetable

The process is reasonably straightforward. Provided you are a ‘qualifying leaseholder’ (see requirements above) you need to take two initial steps:

(i) Get a valuer to advise on what is a fair premium to pay to extend your lease

(ii) Employ a solicitor who is familiar in dealing with this area of law

Following this, you will serve a Notice (a S42 Notice) on the landlord with a proposed premium and the landlord will usually reply by serving a Counter-notice on you which will usually be at a higher number! Then, most of the time, the two parties, using their valuers to negotiate, agree on a premium. Where agreement cannot be reached by negotiation, the correct premium is determined by an independent tribunal.

While it is possible for a lease extension to be executed legally sooner, the usual timetable is 2-3 months where the matter is agreed by negotiation. If the matter proceeds to a tribunal it could take around 12 months. Unless you have time on your hands, this is why it is important to employ a valuer with a strong track record of agreeing lease extensions by negotiation.

The statutory timetable for extending your lease (source: Leasehold Advisory Service)

Will I have to pay any other costs other than those of my valuer and solicitor?

Yes you are required to pay the landlord’s reasonable valuation and legal fees. Other incidental costs include stamp duty.

Calculation of premium to extend your lease

If you extend your lease from say 76 to 166 years the landlord has to wait a lot longer to get its ‘reversion’. The first part of the price you have to pay is therefore the reduction in the landlord’s reversion.

If there are fewer than 80 years remaining you will additionally have to pay half of the ‘marriage value’. This is the difference between the sum of the proposed interests (your extended lease and the landlord’s reversion which is now 166 years away) and the existing interests (your present lease of, say, 76 years, and the landlord’s reversion which is only 76 years away). In this calculation the ability of the leaseholder to extend its lease is disregarded. This is the second element of the calculation.

The third and final element of the calculation is the value of the ground rent which is to be ‘bought down to zero’.

We recommend you take our professional advice on the premium to pay to extend your lease, because it is in your interest: the peace of mind in getting expert professional advice on which you can rely on is important. It also reinforces the second aspect of our advice: negotiating the premium. You may also find it difficult to negotiate with your landlord if your case is based on advice provided by a free online calculator which disclaims all responsibility and recommends you should not "take any other action based on this information without first getting professional advice". You will also of course have to spend your valuable time negotiating - it is likely to take you longer than us for obvious reasons. If you wish to have a look at it before you take professional advice, the Lease Advisory Service offers a free 'calculator'. Please note that you cannot legally rely on this calculator - if you do so and pay too much to extend your lease you will have no recourse to a professional.

The few exceptions which may mean you are not eligible for a lease extension

There are very few - you are not permitted to extend your lease if:

(i) The flat is leased to you by a charitable housing trust on a charitable basis

(ii) You are a business or a commercial tenant (i.e. you have to be an individual)

(iii) The flat is part of a National Trust property

(iv) The flat is part of a property owned by the Crown

(v) The flat is within a cathedral precinct

The landlord can also refuse to extend your lease if there are fewer than five years remaining on the term and there is proof that the property is to be redeveloped.